Build A Tips About Cash Projection Excel

This predicts the future financial.

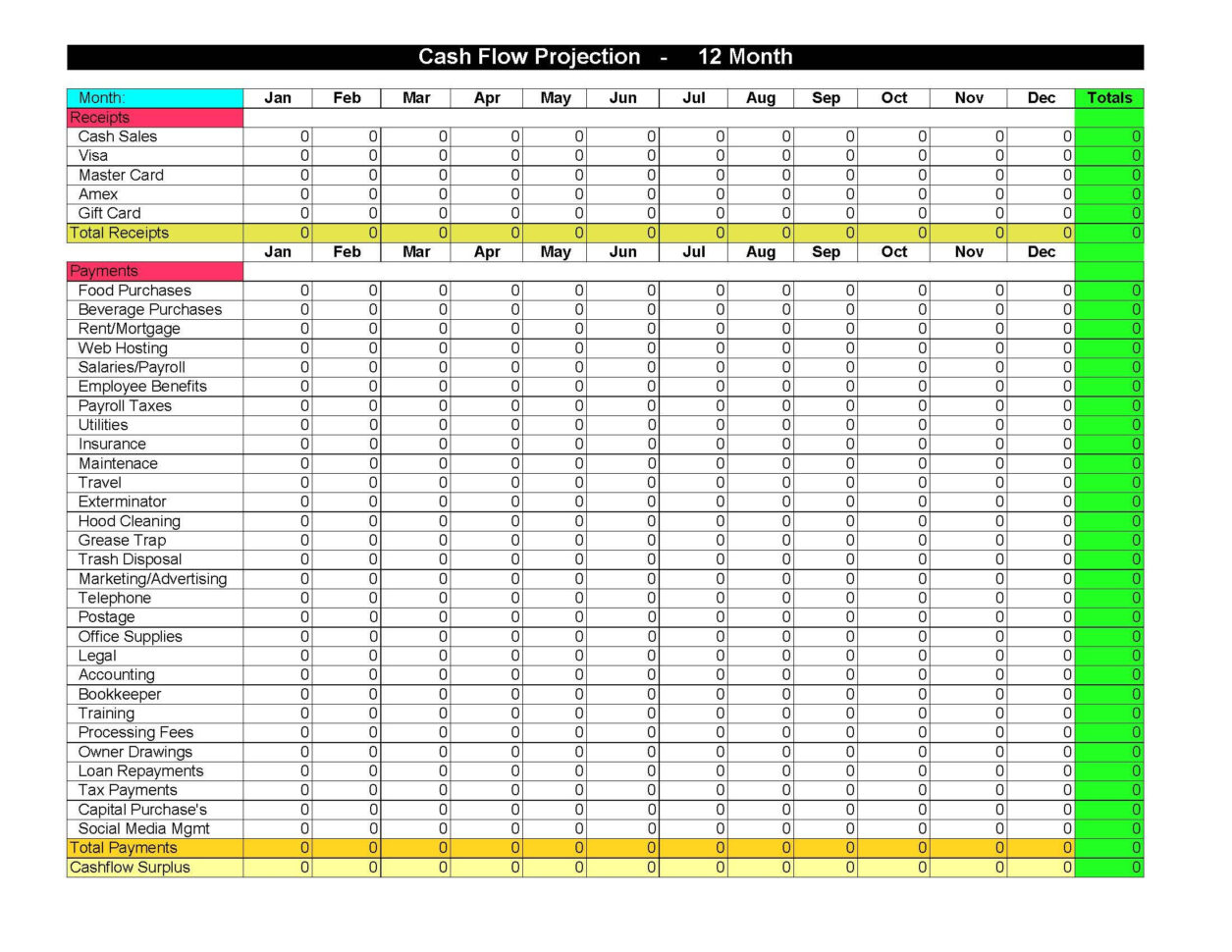

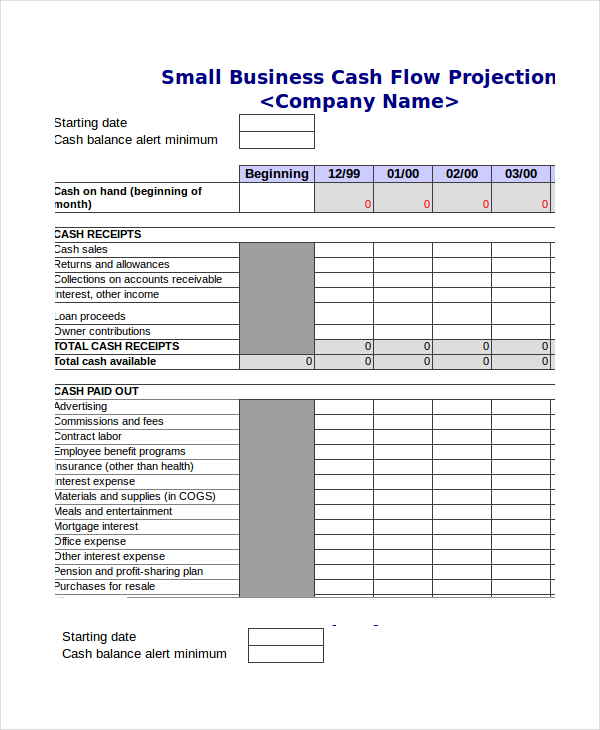

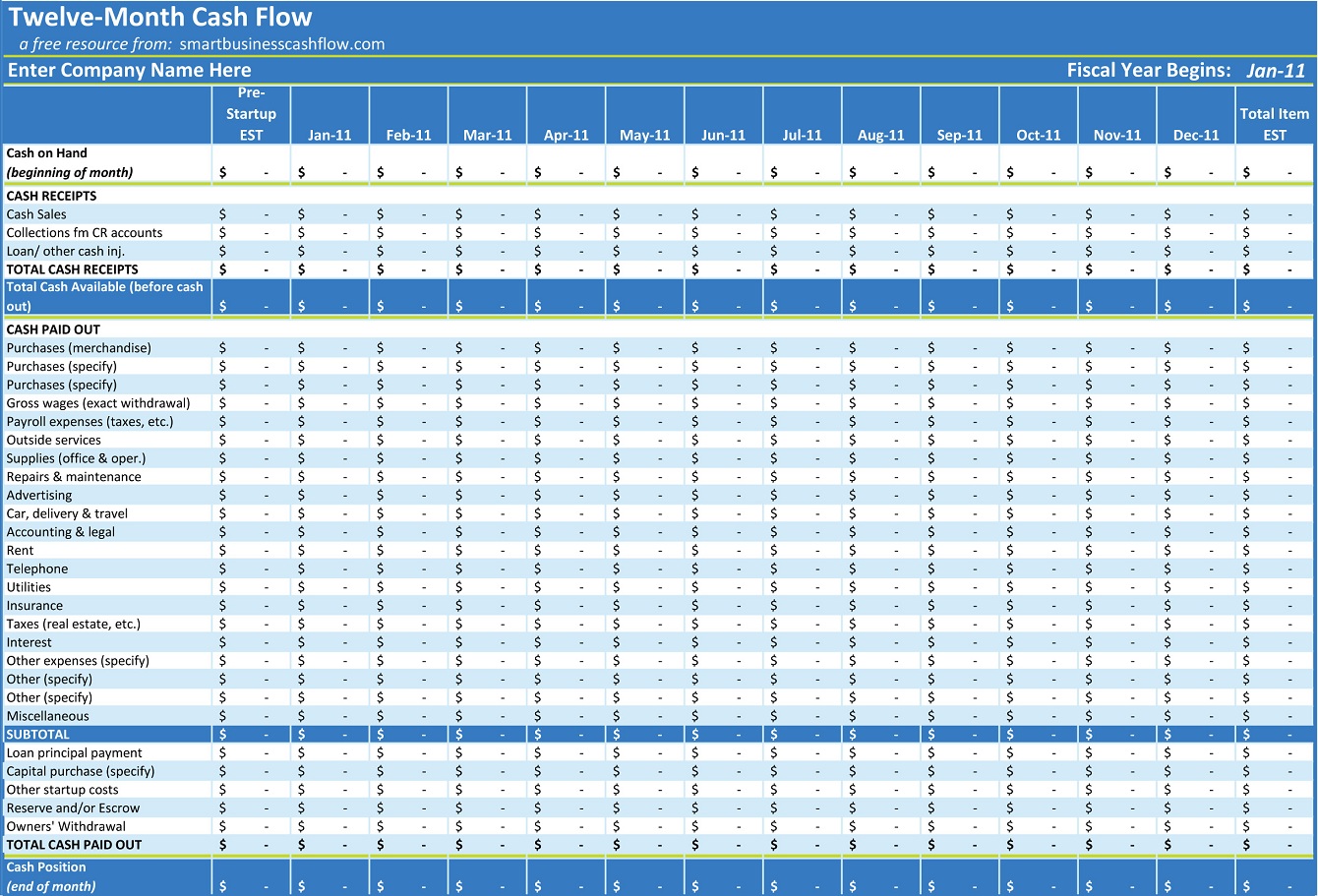

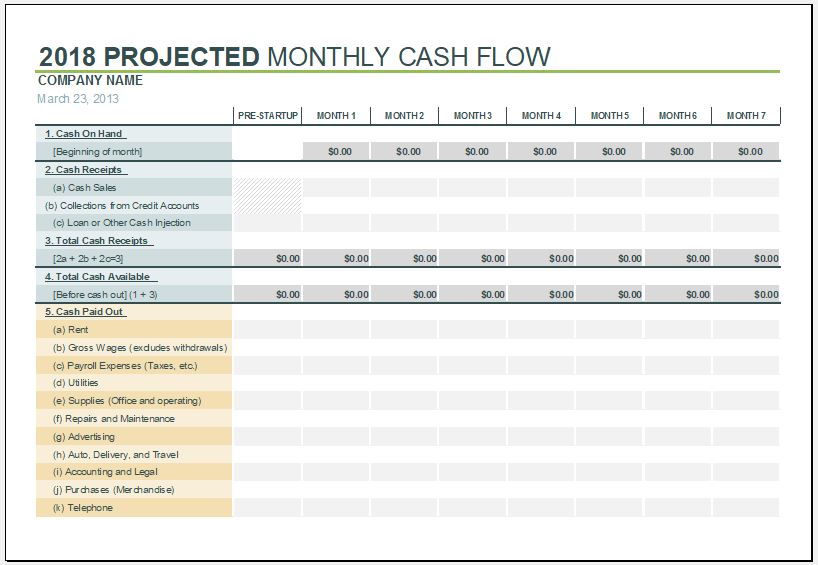

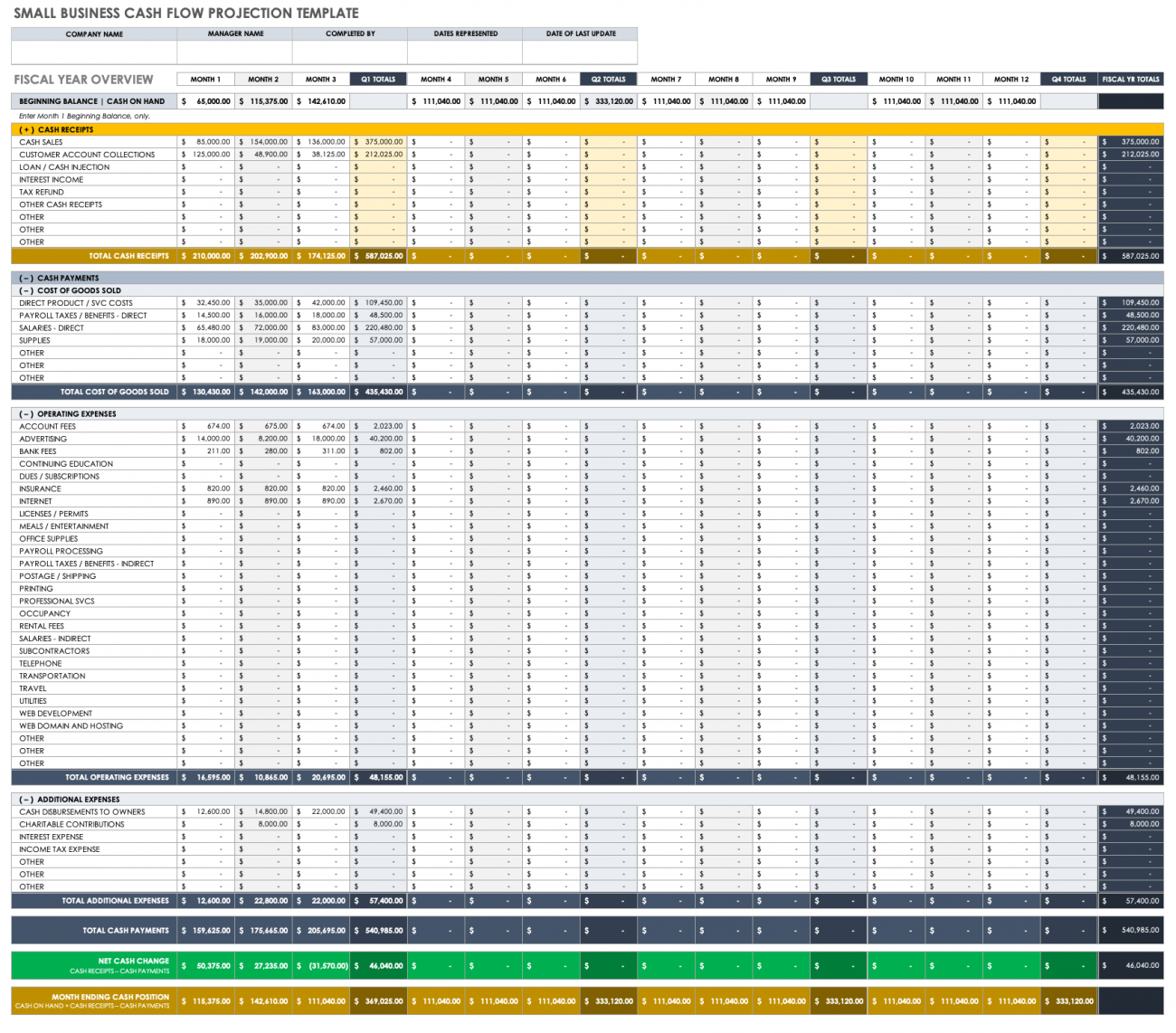

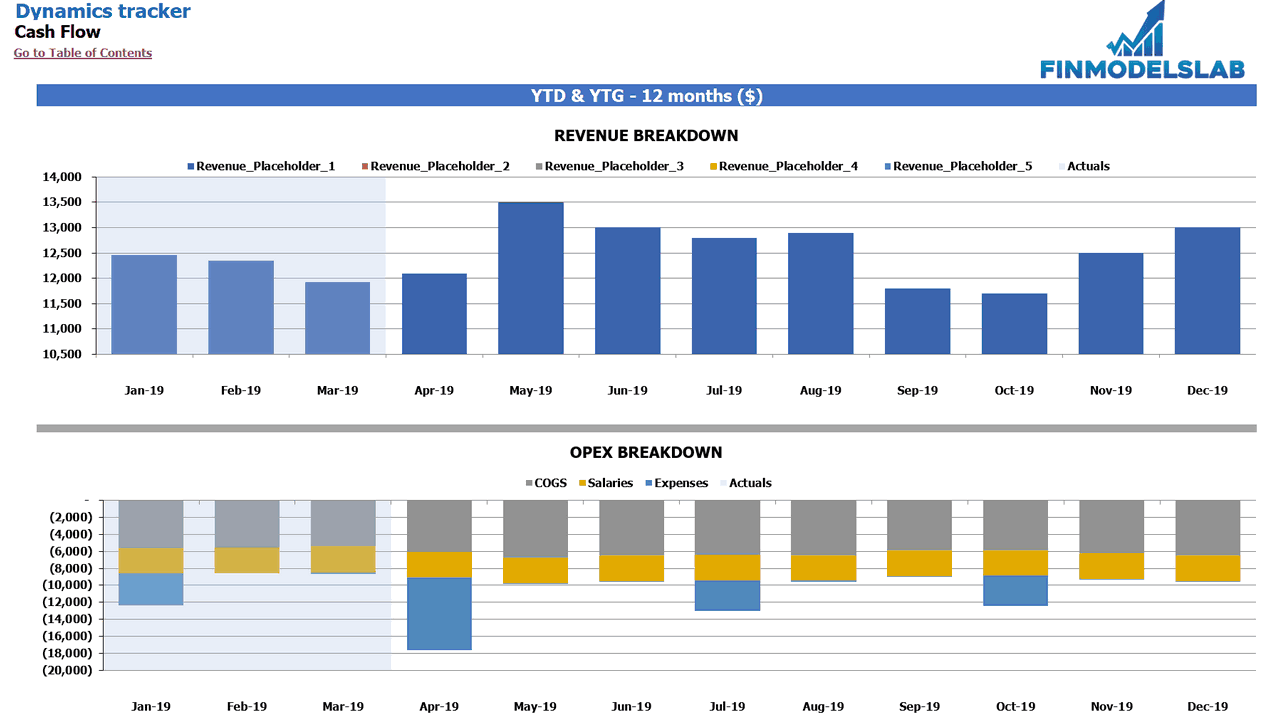

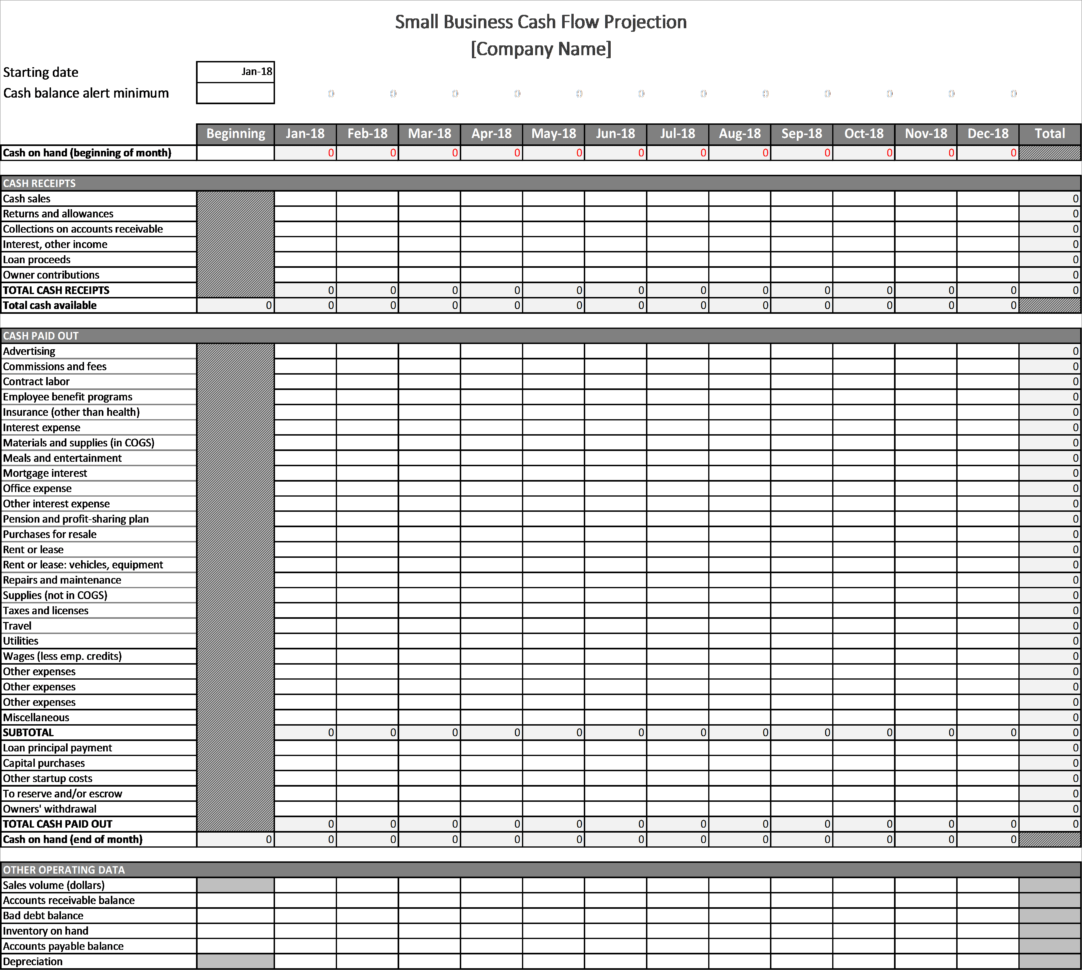

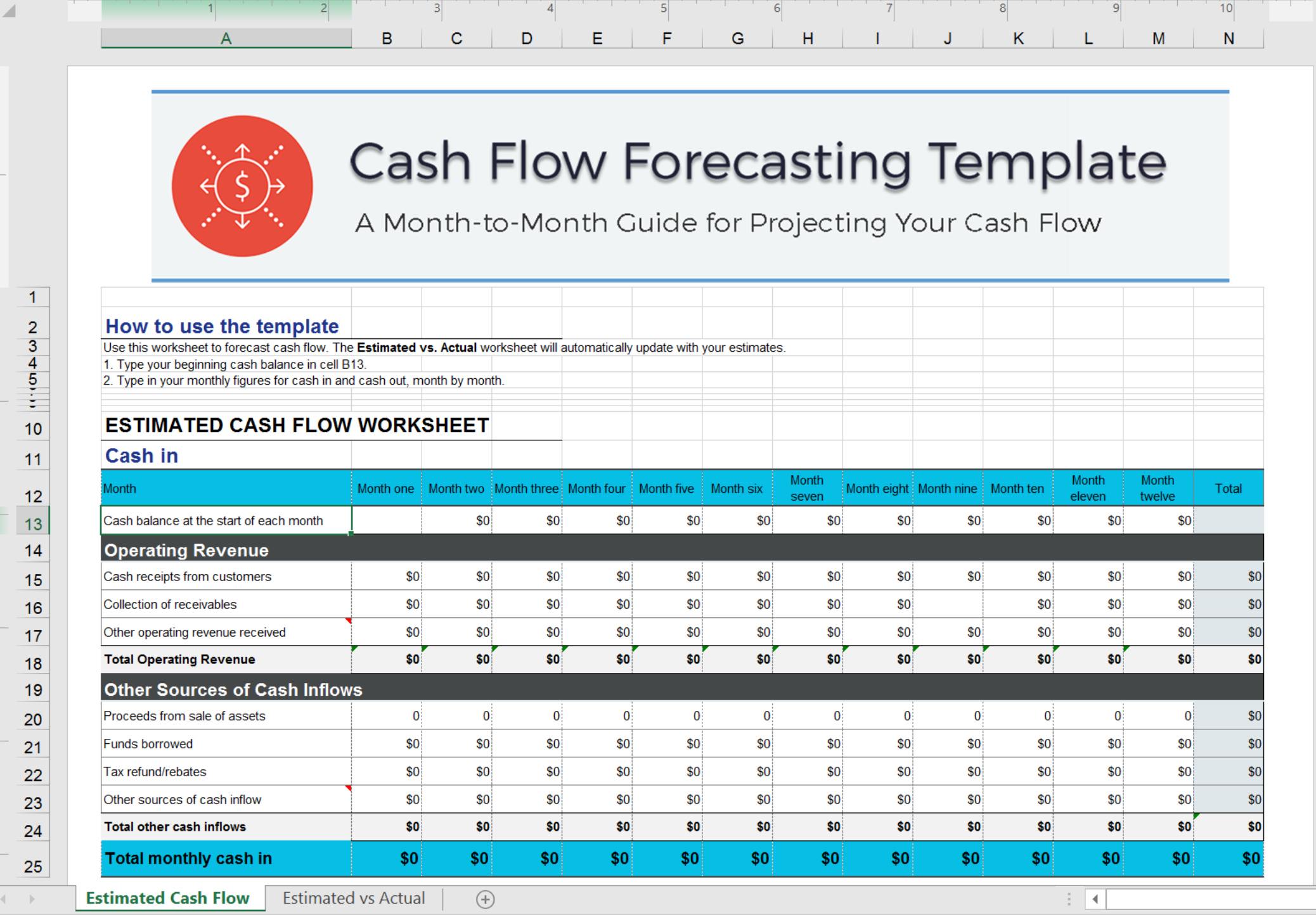

Cash projection excel. This assesses the inflows and outflows of cash, indicating liquidity over time. You can use these tools to build cash flow forecasts, profit. Download cash flow projection excel template.

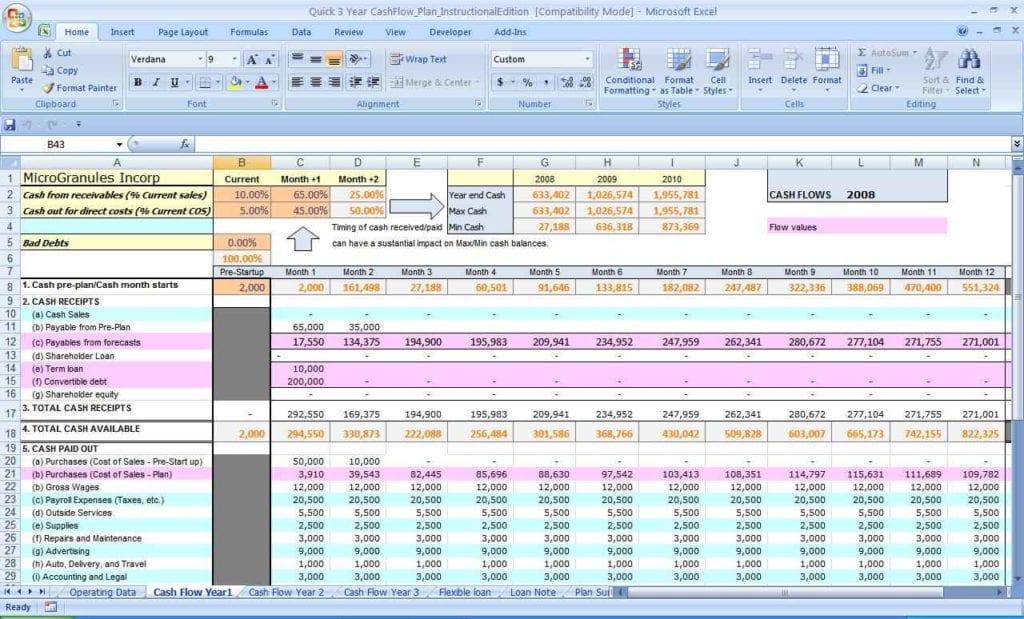

Cash flow projection is a statement showcasing expected amount of money to be received into, or paid out of, the business over a period of time. Use one of the columns to explain the assumptions and their origin further. This should be at the top of the cash flow projection format in the excel spreadsheet.

Cash flow projections are based on user defined monthly. Set goals and fill out your prep sheet tab part 2: It should look like this with.

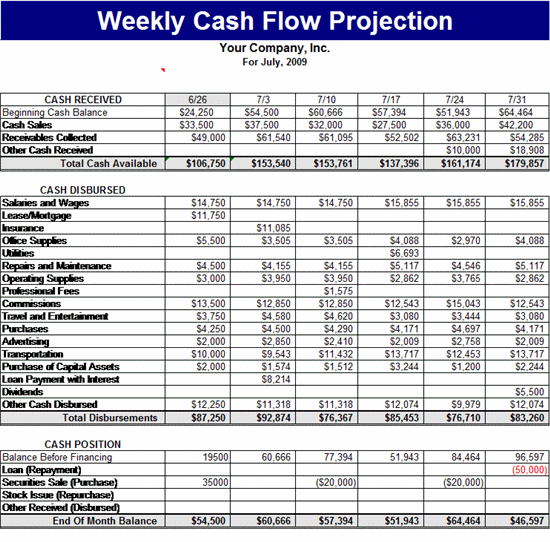

To help get them started, this tutorial shows how to build a. First of all, let’s enter the time periods. Annual cash flow projections are based on user defined turnover, gross.

Monthly rolling cash flow projection excel model. For that, select cell c4 and write down “january 2022”. Use your model to make projections welcome.

Here’s how to do a cash flow projection in excel: Estimate your monthly sources of cash. Advantages of using cash flow projection template excel following are benefits associated with the using of this template changes are made according to firm.

But many starting out in business do not have a basic appreciation of what goes into the cash forecast. Use this cash flow forecast template to create annual cash flow projections in excel for 5 annual periods. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out based on.

Use this cash flow projection template to compile monthly cash flow projections for 36 monthly periods in excel. So we need to enter months as time intervals. A cash flow projection (or cash flow forecast), looks forward to the coming month (or months, or quarter, or whatever time period you want to create a forecast for),.

Build your cash flow forecasting model (you are here) part 3: