Have A Info About Cost Basis Spreadsheet

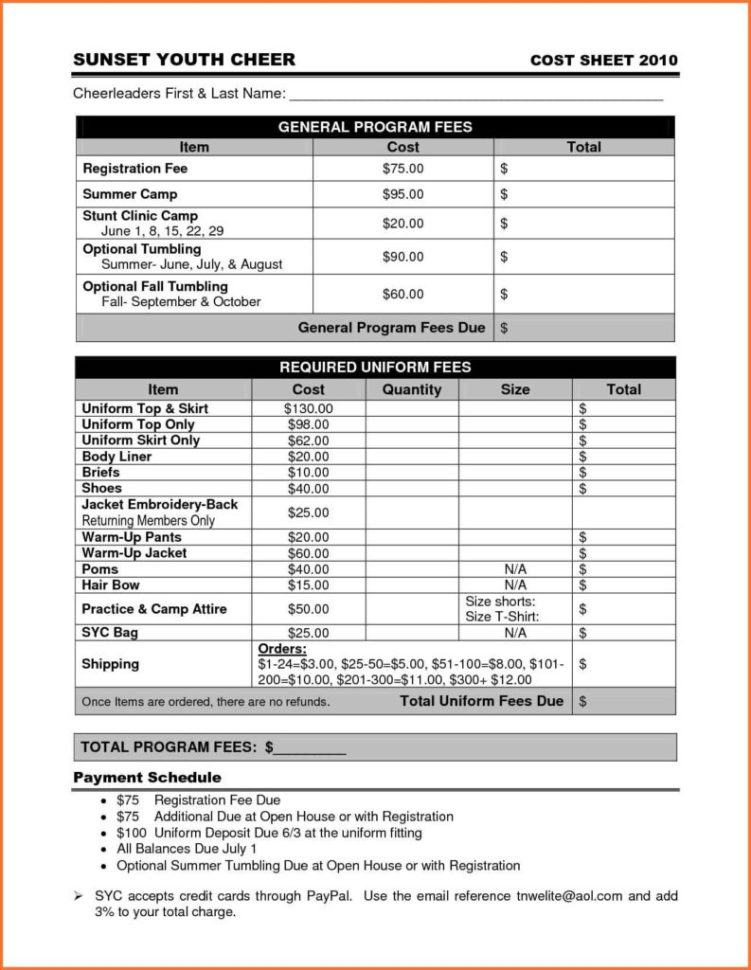

Handouts for sellers worksheet:

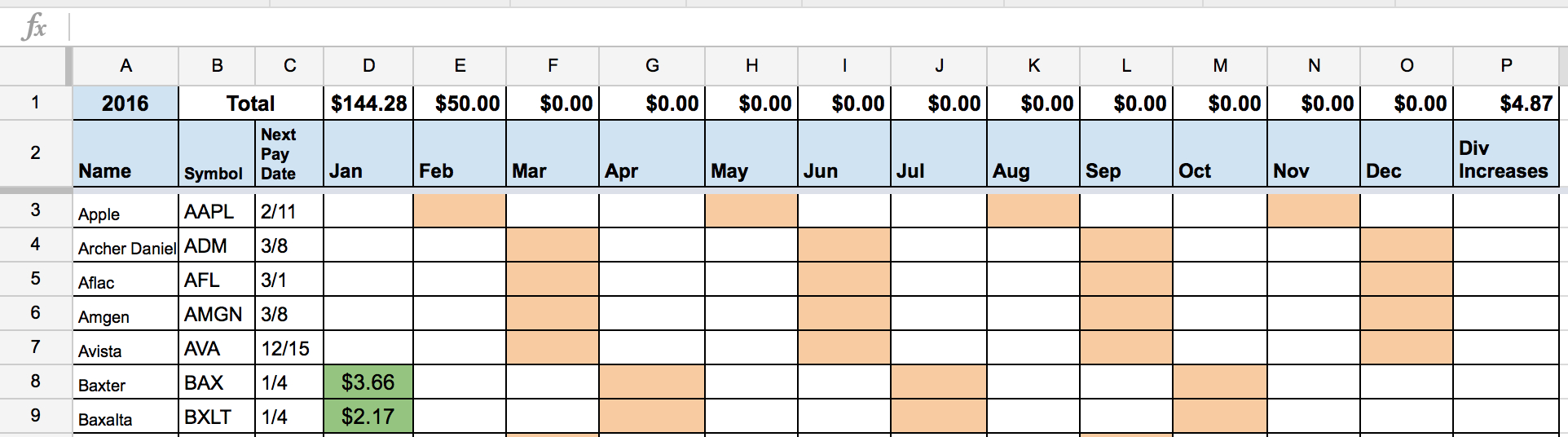

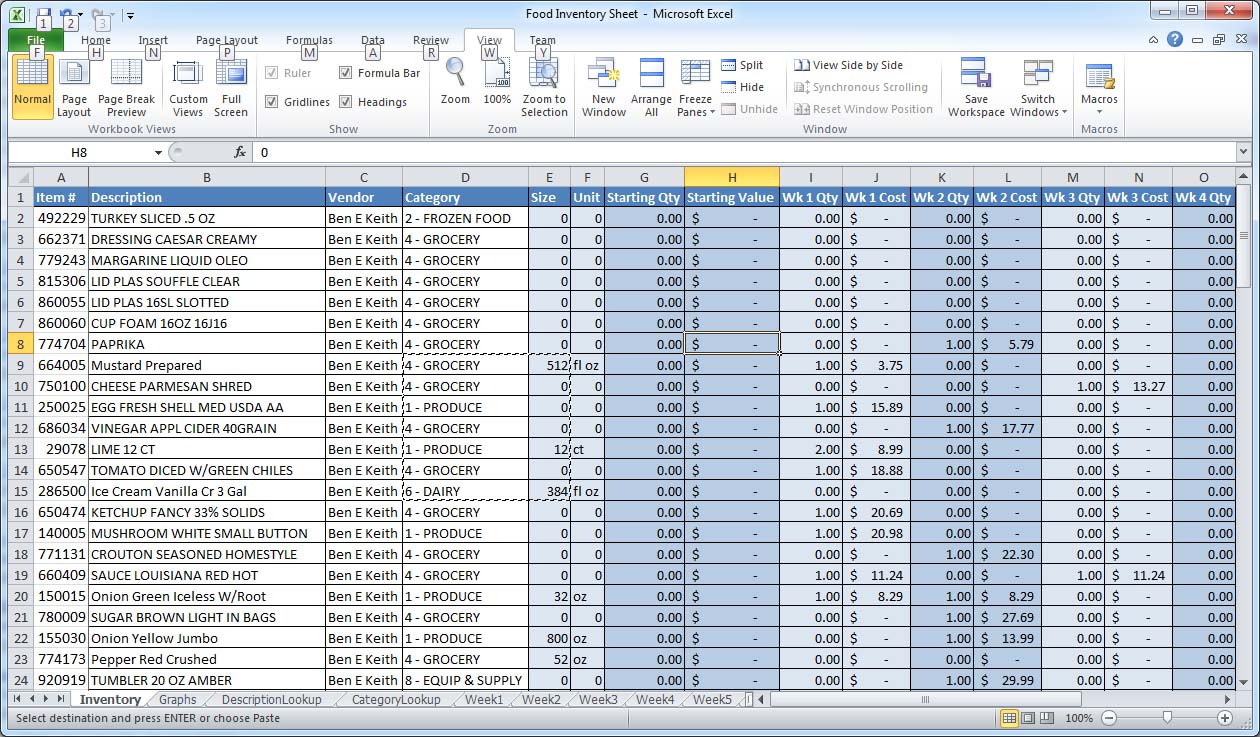

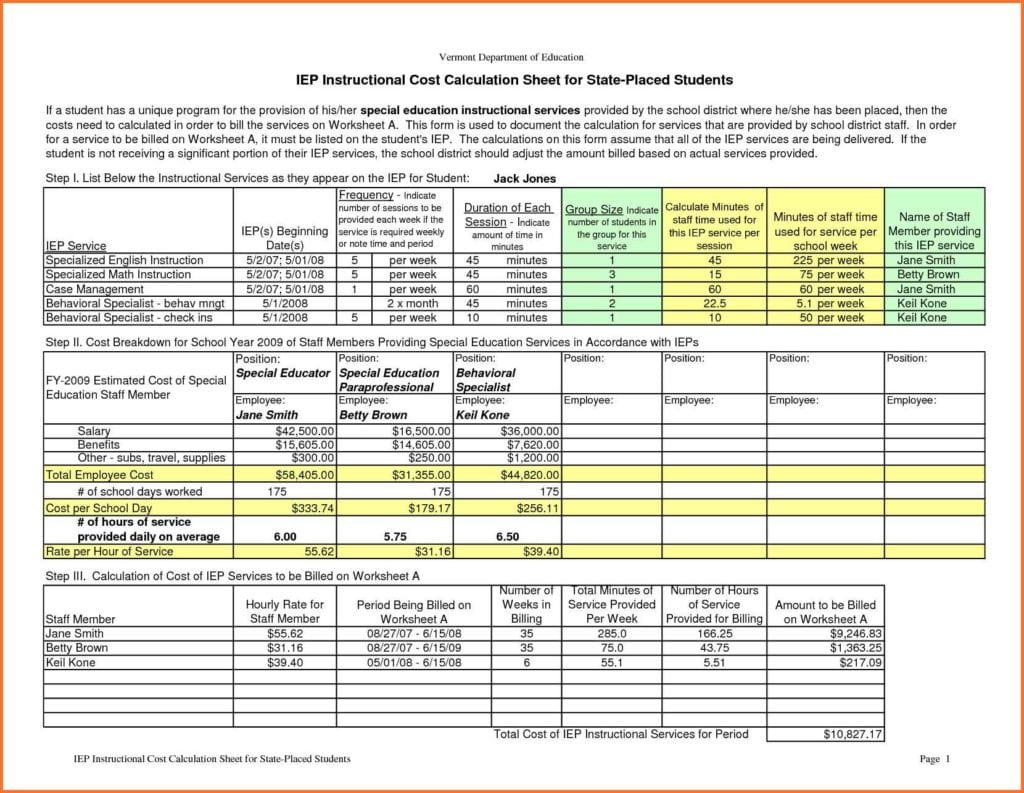

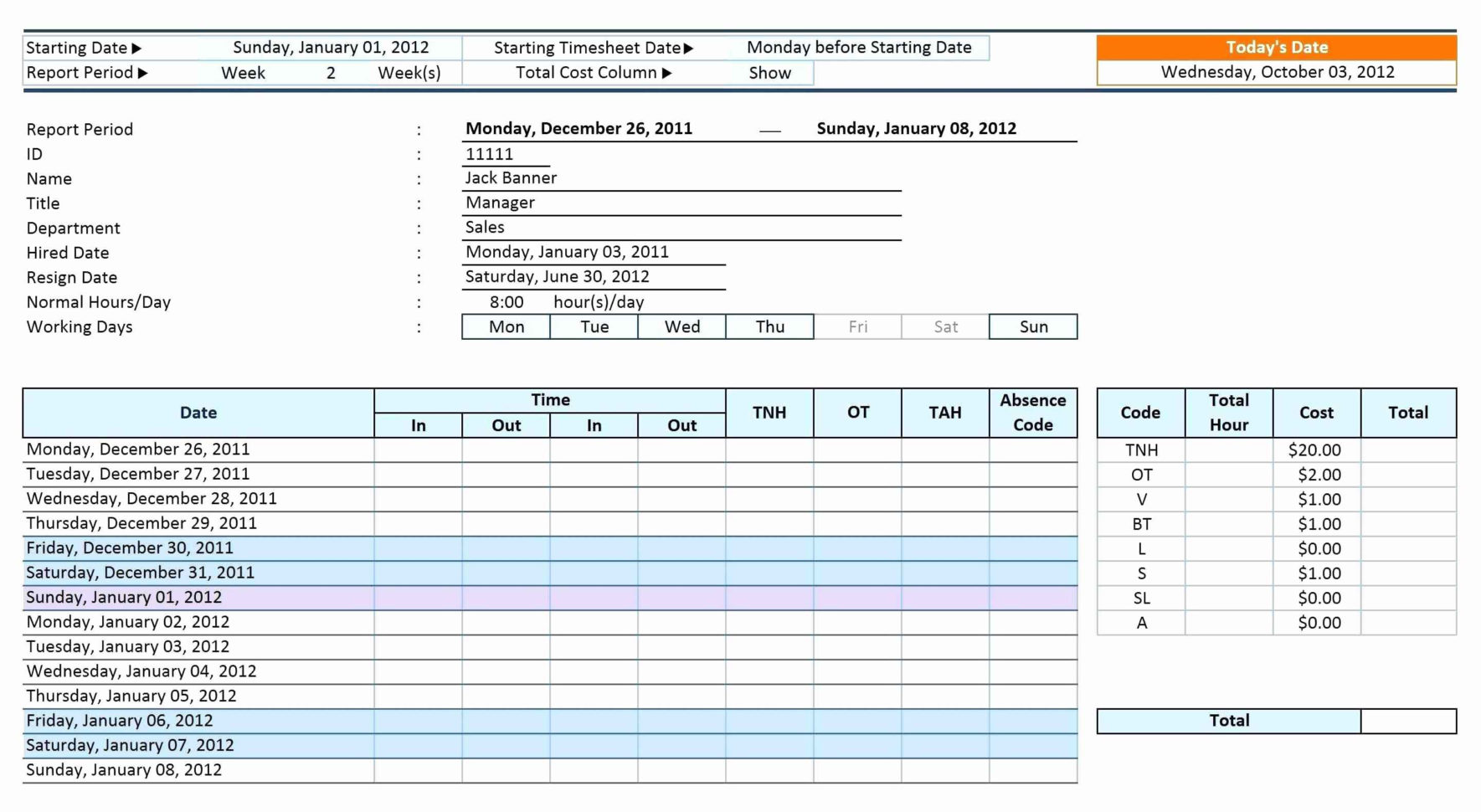

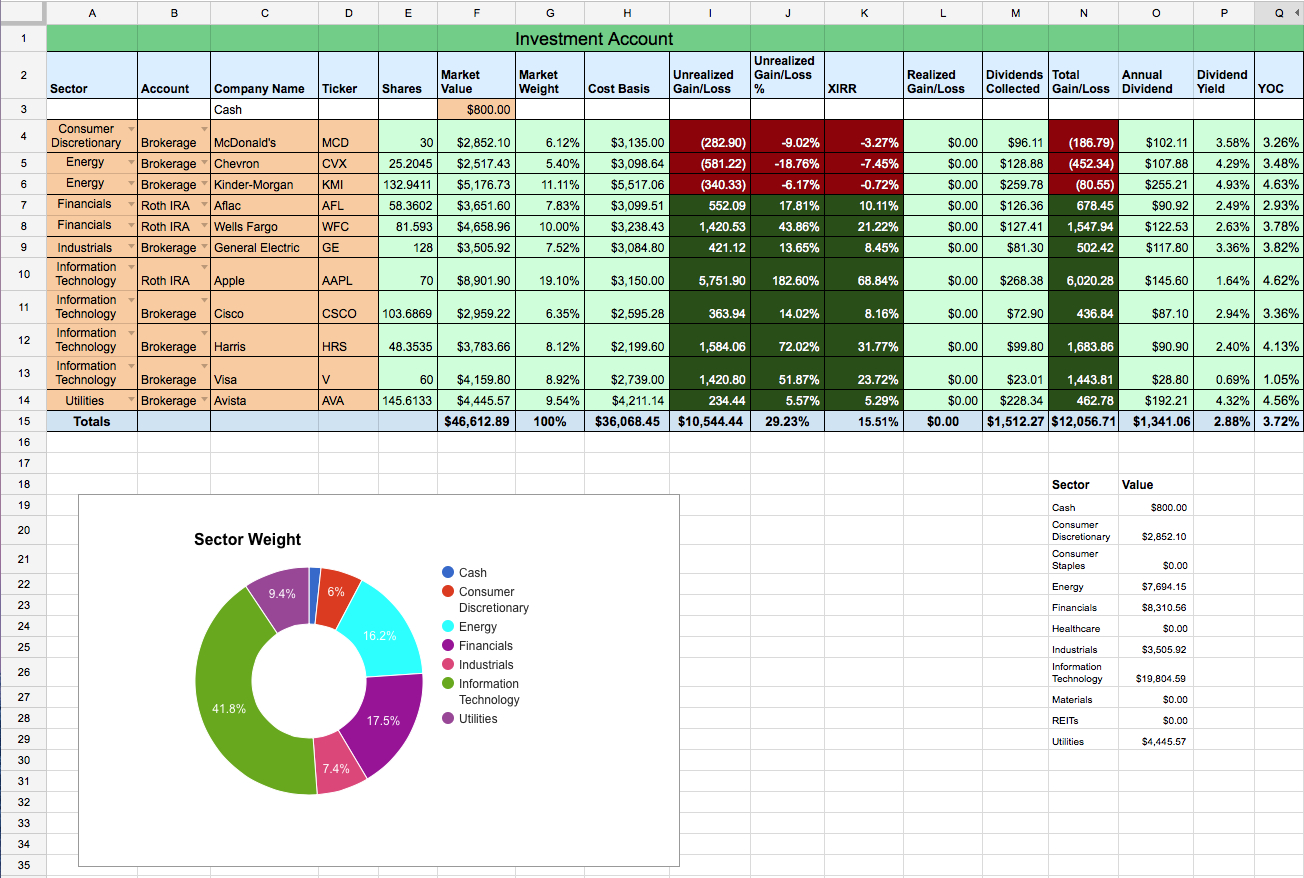

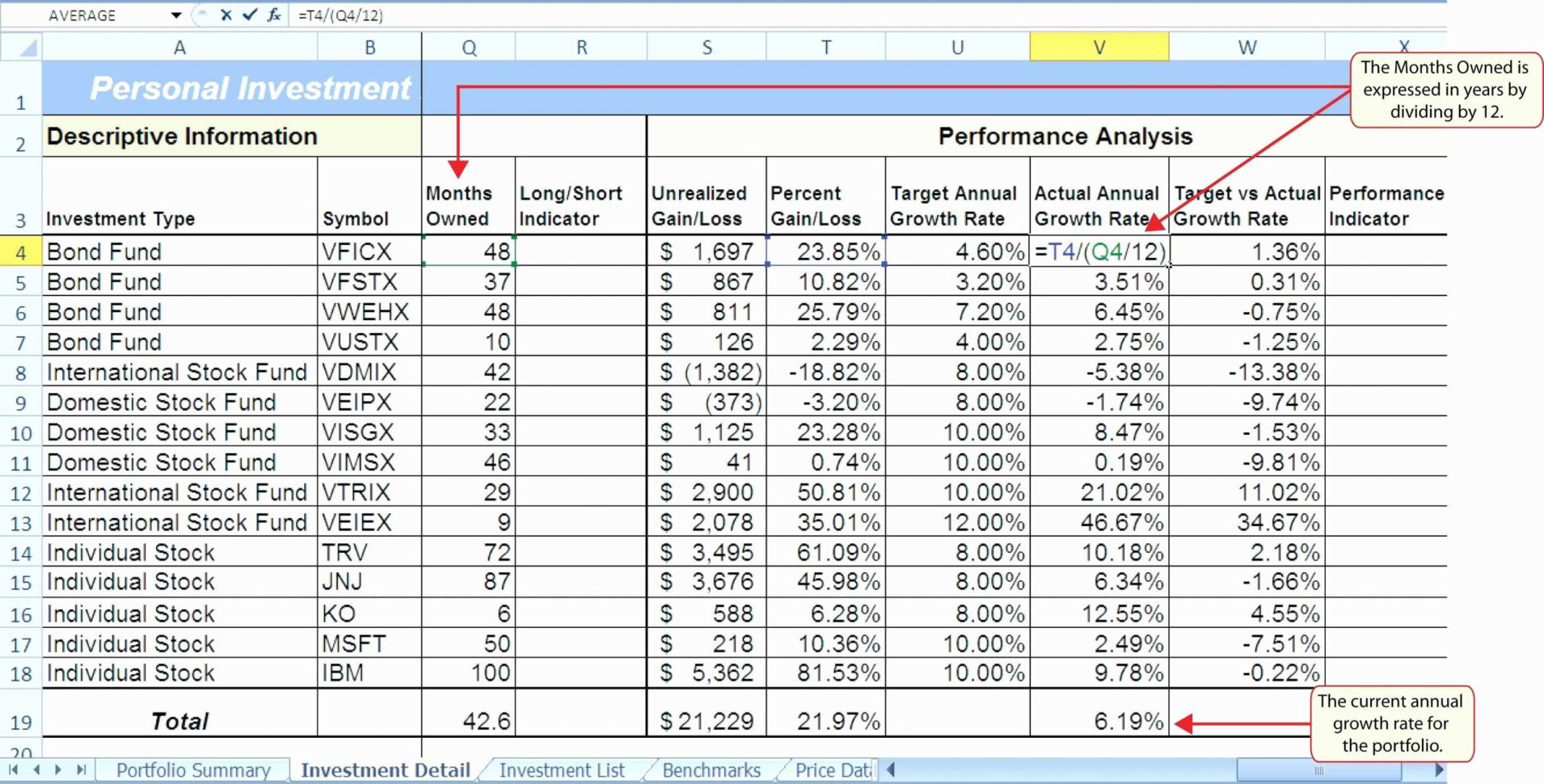

Cost basis spreadsheet. Enter a security identifier, search the cusip database. However i just want to a create a spreadsheet where one column has the amount of. Purchase average cost number of cost basis of sales gain or date of date this purchase cumulative this purchase cumulative per share shares sold shares sold # of.

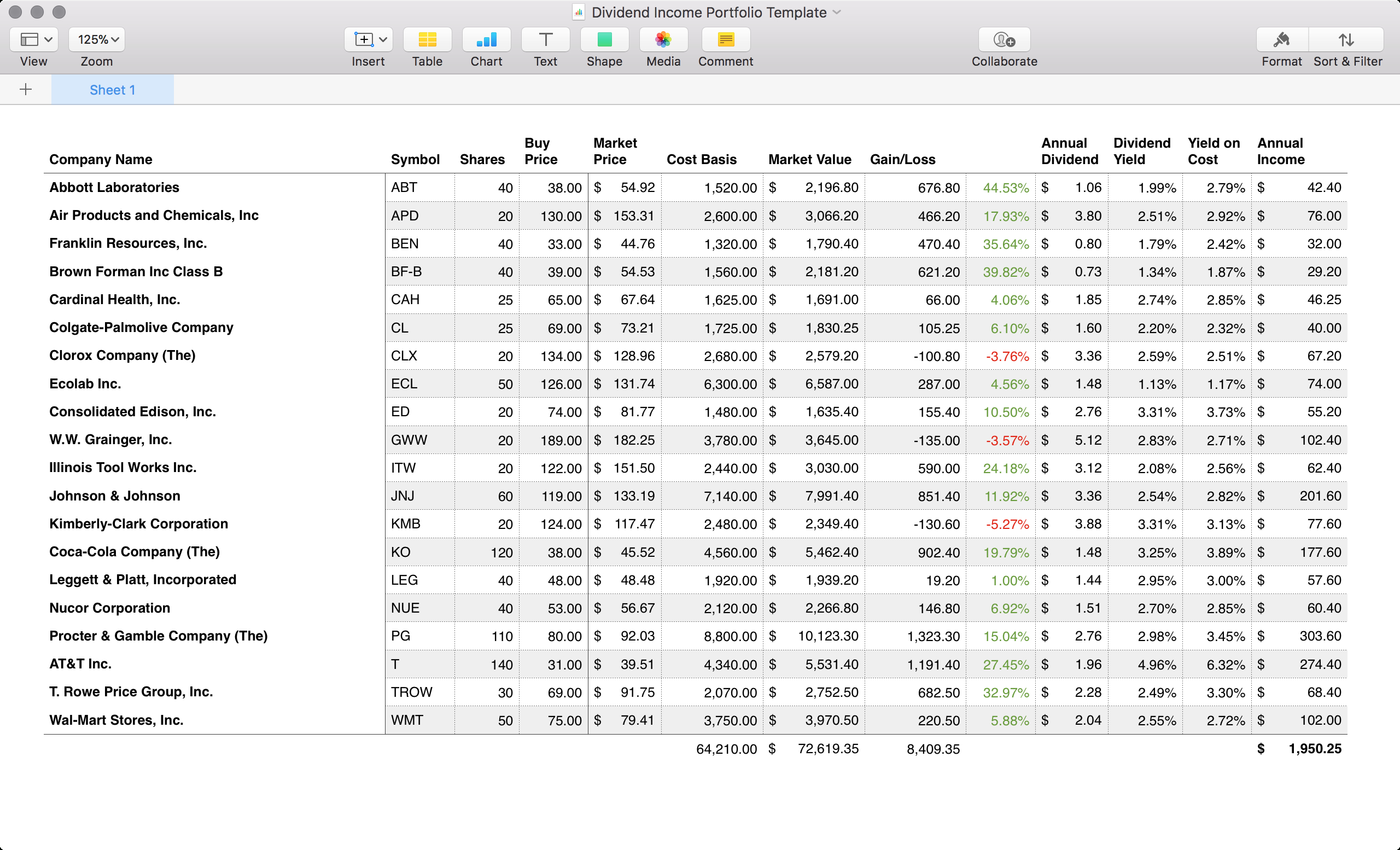

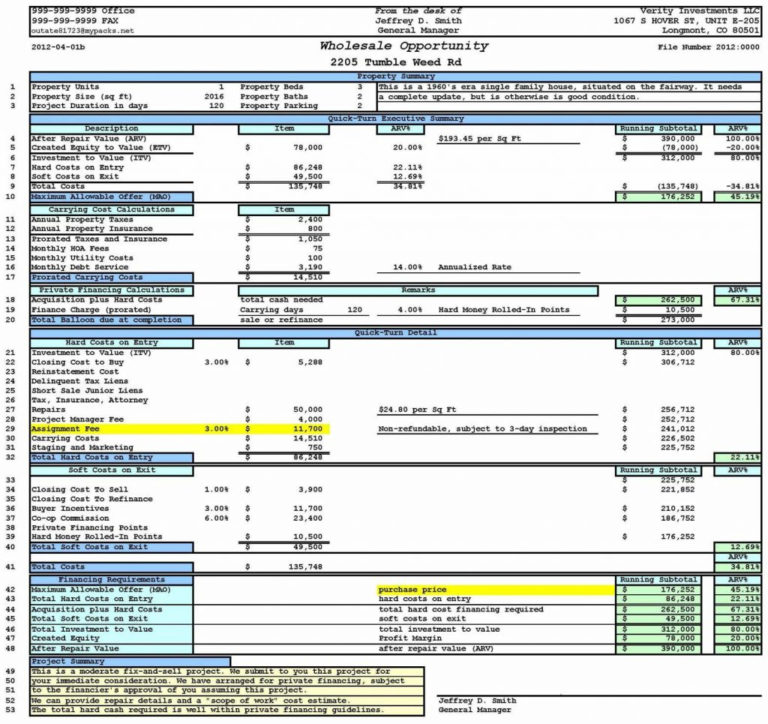

In real estate, the cost basis is the original value that a buyer pays for their property. Calculate capital gains when you sell a stock, you owe taxes on the difference between what you paid for the stock and how much you got for. Cost basis is the original price or cost of an asset purchased by an investor.

Return of principal calculator spinoff. Divide the total amount paid by the total number of shares purchased to get. Cost basis is the original purchase price of an asset.

The last cell, gain/loss can be figured out by subtracting the cost basis from the sell price and then subtracting the final commission cost: How to calculate your real estate. With this method for each sale transaction we calculate average cost basis per share using information.

At the time of a sale, figure the total number of shares purchased and the amount paid. Learn about your options for calculating your mutual fund cost basis, used to determine the taxable gain or loss of an asset sold from t. Select cost basis plus , then continue.

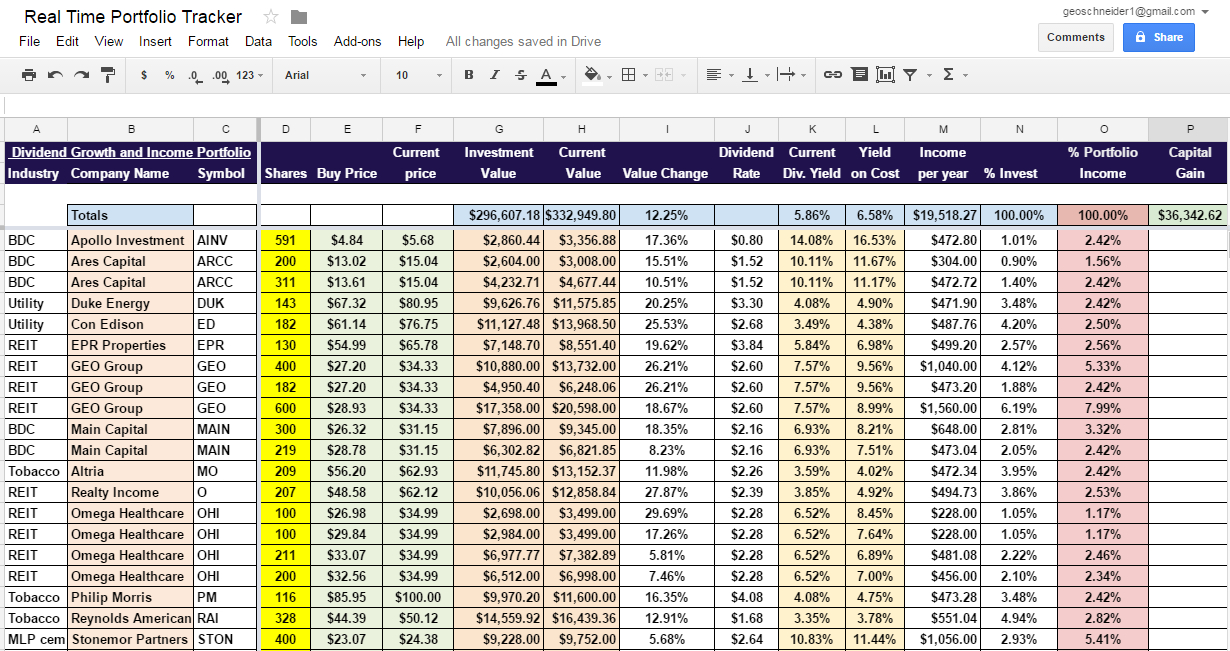

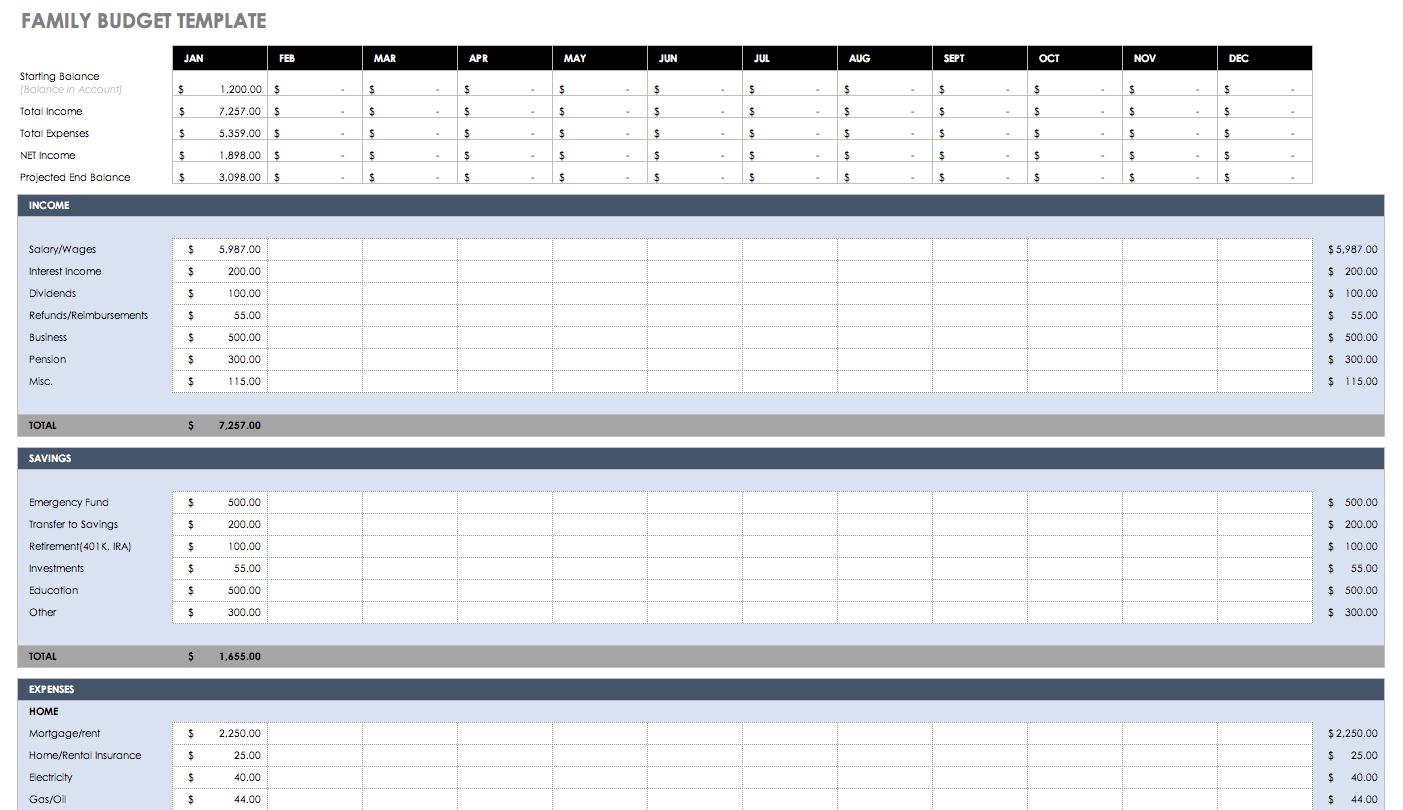

You can use this free real estate cost basis spreadsheet template to help you calculate and track your cost basis over time. It is used for tax purposes when calculating capital gains or losses. Portfolio slicer currently calculates cost basis using average method.

Moneybinds’ free cost basis calculator (with drip) allows you to calculate how much you’ve invested in a stock per share, including taxes, additional commissions paid, and. With this stock cost basis calculator, you can determine the total cost basis of your investment.

I am a total noob when it comes to spreadsheets so forgive my rather novice question. In accounting, we need to know the cost basis of an asset, like a share. For example, let’s say you recently bought a rental property for $250,000.

You can download version 1.1 here. By entering the number of shares (units) and share price (cost per unit), you. This includes, but is not limited to, the price paid for the property,.

The hpaa cost basis spreadsheets cover the various stock purchase plans over the years (which had discounts varying between 33% and 0%.) if employee stock purchase.